- Details

- Category: Senator Willie Preston News

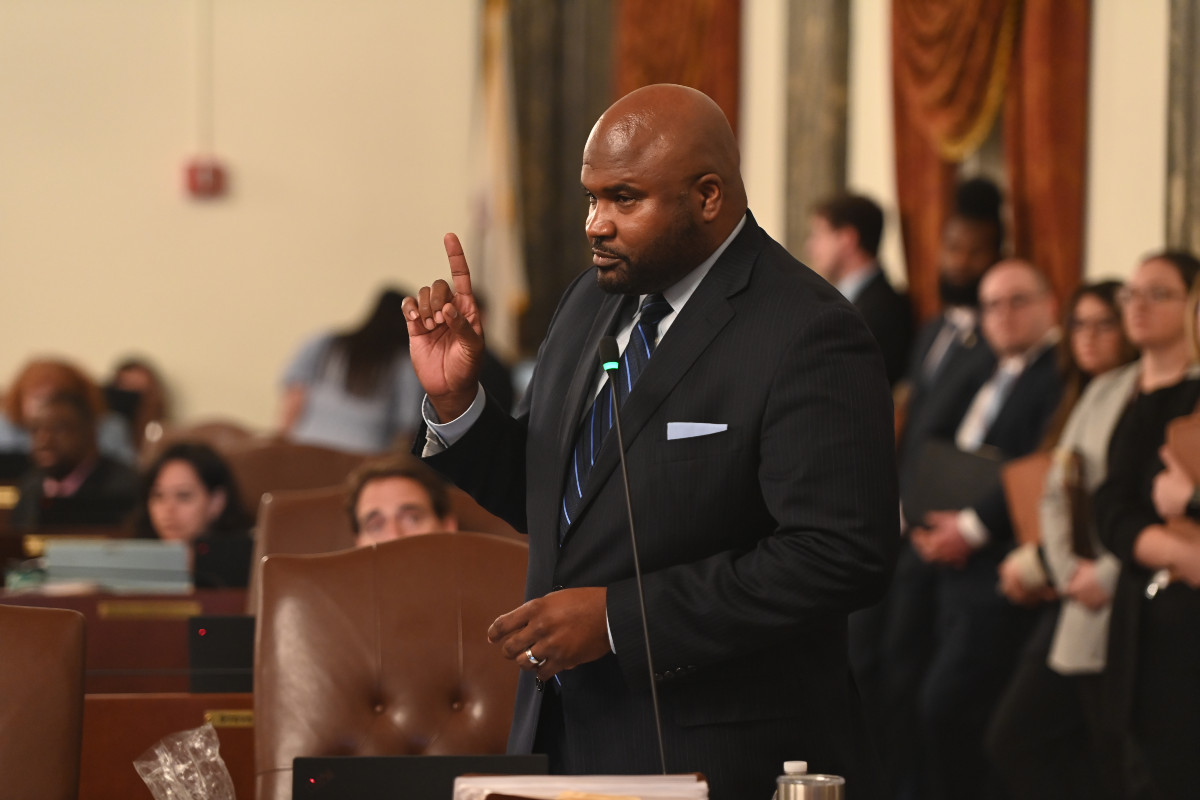

SPRINGFIELD – During his first year in office, State Senator Willie Preston (D-Chicago) was proud to support a budget that prioritizes education from birth to college, enhances workforce development, and includes efforts to uplift low- and middle-class families.

SPRINGFIELD – During his first year in office, State Senator Willie Preston (D-Chicago) was proud to support a budget that prioritizes education from birth to college, enhances workforce development, and includes efforts to uplift low- and middle-class families.

In response to the Fiscal Year 2024 budget passing the Senate, Preston released the following statement:

“The working class people of the 16th District sent me to Springfield to help shape a budget that provides educational and career opportunities that promote stabilization of our communities, support the re-emergence of entrepreneurship in our most economically challenged communities, and ensure equitable opportunities for all. I am excited to expand these opportunities to many of the residents in the area who have been underserved.”

“The investments in apprenticeship programs, early childhood, and higher education are amongst the highest investments to professional development and our education system in years. This budget uplifts the education system, supports the entrepreneurial spirit, and expands the workforce to ensure that everyone is awarded the opportunity to provide for their families and build their communities.”

- Details

- Category: Senator Mike Porfirio News

SPRINGFIELD – State Senator Mike Porfirio helped spearhead a measure through the Senate making significant strides to expand the AIM HIGH Grant Pilot Program.

“Making the AIM HIGH program permanent will have profound impacts for our universities and residents,” said Porfirio (D-Lyons Township). “This program gives our residents more in-state opportunities to pursue higher education.”

The Aspirational Institutional Match Helping Illinois Grow Higher Education (AIM HIGH) has provided merit-based, means-tested student financial aid to first-time, full-time undergraduate students and transfer students who are Illinois residents attending any of the 12 Illinois public four-year universities since 2019.

House Bill 301 makes the AIM HIGH Grant Pilot Program permanent, increases transparency in the program to allow more students to take advantage of it, increases access for part-time students and makes changes to the matching requirements for the public universities.

- Details

- Category: Member News

SPRINGFIELD – Building upon the success of the Fiscal Year 2023 budget, the Illinois Senate Democratic Caucus passed the Fiscal Year 2024 budget Thursday, continuing the state on a path toward fiscal responsibility and investing in education from preschool to college.

“This budget continues the work Democrats have done to restore economic prosperity to our state,” said Senate President Don Harmon (D-Oak Park). “This was a collaborative effort. I am proud of the work we did, and I look forward to the House sending this balanced budget to the governor so he can sign it into law.”

The budget prioritizes business attraction and development, workforce training, economic assistance programs, and more. It includes funds to support job creation, improve commercial corridors and attract new businesses to the state.

“As Chair of the Senate Appropriations Committee, I set a goal that our budget would work to solve the pressing economic issues facing low- and middle-income families,” said State Senator Elgie R. Sims, Jr. (D-Chicago). “Because of our responsible fiscal approach, particularly the last few years, our state continues to have fiscal stability while caring for the people of our state.”

- Details

- Category: Senator Laura Murphy News

SPRINGFIELD –To ensure children with asthma, allergies and other medical conditions can enjoy after-school programs and activities safely, State Senator Laura Murphy has introduced legislation to allow program employees to administer life-saving medication to kids.

SPRINGFIELD –To ensure children with asthma, allergies and other medical conditions can enjoy after-school programs and activities safely, State Senator Laura Murphy has introduced legislation to allow program employees to administer life-saving medication to kids.

“At school, children can depend on their school nurse or other trained personnel to help with an EpiPen or inhaler. However, during after-school programs, there is not always that level of continuity with the regular school day,” said Murphy (D-Des Plaines). “This legislation will give parents the confidence and peace of mind to enroll their children in sports, art classes and other enriching programs.”

Read more: Murphy plan allows after-school employees to administer EpiPens, inhalers

- Details

- Category: Senator Julie A. Morrison News

SPRINGFIELD – Less than a year after State Senator Julie Morrison and her family ran for their lives as a man opened fire from a rooftop in Highland Park, she passed a measure to enhance public safety through the use of drones.

SPRINGFIELD – Less than a year after State Senator Julie Morrison and her family ran for their lives as a man opened fire from a rooftop in Highland Park, she passed a measure to enhance public safety through the use of drones.

“Drones provide an invaluable resource that can be used to monitor large crowds for suspicious activity,” said Morrison (D-Lake Forest). “This technology exists – there’s no reason we shouldn’t put it in the hands of law enforcement.”

The Morrison-led measure allows law enforcement to use drones to monitor special events, like parades and festivals, to detect breaches and identify public safety issues.

It comes in response to the Fourth of July mass shooting that killed seven and wounded dozens more in Highland Park. The shooter fired a rifle on parade crowd from the rooftop of a downtown building.

“The devastating July day in Highland Park underscored the need for increased public safety initiatives for large events,” said Morrison. “I can’t help but wonder what the outcome of that July day would’ve been had this law been in place.”

“The City of Highland Park appreciates the work of Senators Morrison and Holmes leading on legislation that will broaden the use of drones by public safety in certain situations, specifically for preventative use against public safety threats towards public gatherings,” said Highland Park Mayor Nancy Rotering. “Allowing our public safety personnel the use of drones to monitor large scale public events will increase their ability to secure an area, and save time while improving the delivery of life-saving services.”

House Bill 3902 passed the Senate Wednesday.

- Details

- Category: Senator Christopher Belt News

SPRINGFIELD – The Illinois State Senate passed a revenue package Wednesday containing a number of tax credits and tax emptions, including two measures championed by State Senator Christopher Belt that provide tax incentives to electric vehicle manufacturers and aircraft engine suppliers and manufacturers.

SPRINGFIELD – The Illinois State Senate passed a revenue package Wednesday containing a number of tax credits and tax emptions, including two measures championed by State Senator Christopher Belt that provide tax incentives to electric vehicle manufacturers and aircraft engine suppliers and manufacturers.

“The electric vehicle industry showcases the potential for the future of our state,” said Belt (D-Swansea). “Not only do these measures incentivize growth of the electric vehicle and aircraft engine industries, but also it will drive economic prosperity in Illinois while reinforcing the state’s commitment to fostering a sustainable business environment.”

Read more: Belt secures tax credits and exemptions for aircraft engines, EV manufacturers

- Details

- Category: Senator Patrick Joyce News

SPRINGFIELD – The City of Kankakee will now be the latest community to be a part of the River Edge Redevelopment Zone Program, thanks to State Senator Patrick Joyce’s leadership to get Senate Bill 1963 over the finish line.

“When I was growing up, downtown Kankakee was a vibrant area full of small businesses and things to do,” said Joyce (D-Essex). “By adding Kankakee to the list of towns eligible to be in the River Edge Redevelopment Zone, investors and small business owners alike will have tax incentives to invest in the downtown area. This action aims to bring back businesses and give old river communities another chance for development.”

The River Edge Redevelopment Zone Program helps revive and redevelop environmentally challenged properties adjacent to rivers in Illinois. Currently, the River Edge Redevelopment Zone Act authorizes the Illinois Department of Commerce to designate zones in five cities: Aurora, East St. Louis, Elgin, Peoria and Rockford. This new legislation will add Kankakee and Joliet to the list of authorized municipalities in the zones.

Read more: Joyce opens the door for new developments in downtown Kankakee

- Details

- Category: Senator Linda Holmes News

SPRINGFIELD – On Feb. 15, 2019, a mass shooting took place at Henry Pratt Company in Aurora. Within 90 minutes of the shooter’s arrival, five people had been killed by the gunman. Five police officers were injured along with another civilian. The Aurora Police Department began reviewing the case for opportunities to use their drones at events; over the next three years, a plan was formed.

SPRINGFIELD – On Feb. 15, 2019, a mass shooting took place at Henry Pratt Company in Aurora. Within 90 minutes of the shooter’s arrival, five people had been killed by the gunman. Five police officers were injured along with another civilian. The Aurora Police Department began reviewing the case for opportunities to use their drones at events; over the next three years, a plan was formed.

On Wednesday, Aurora’s State Senator Linda Holmes brought the work of law enforcement agencies who studied how the use of drones could play a role in protecting the public in mass shooting events, and House Bill 3902 – the Drones as First Responders Act – was heard and passed in the Senate.

“This measure gives police and other first responders critical information in a chaotic situation where lives are at stake,” said Holmes (D-Aurora). “This capability could spare another community the suffering and trauma we experienced here.”

Read more: Holmes advocates for drone use by law enforcement for public safety

More Articles …

- Hunter creates joint cause scratch-off lottery game

- Senator Fine passes rate review legislation, prevents excessive rate increases on health insurance

- Senator Halpin’s legislation gives more in-state students access to Illinois universities

- Holmes produces savings for Aurora with smarter disposal of water treatment product

Page 183 of 764

© 2026 Illinois Senate Democratic Caucus

© 2026 Illinois Senate Democratic Caucus