- Details

- Category: Senator Christopher Belt News

EAST ST. LOUIS – State Senator Christopher Belt (D-Swansea) is proud to announce two local fire departments will receive funding through the Small Equipment Grant Program, administered by the Office of the Illinois State Fire Marshal for equipment upgrades.

EAST ST. LOUIS – State Senator Christopher Belt (D-Swansea) is proud to announce two local fire departments will receive funding through the Small Equipment Grant Program, administered by the Office of the Illinois State Fire Marshal for equipment upgrades.

“This program gives eligible departments the opportunity to purchase small equipment that they may otherwise not be able to afford,” Belt said. “Thanks to the small equipment grants, these fire departments will be able to provide better service to residents and families in our community.”

The Small Equipment Grant Program was established by the Office of the State Fire Marshal to provide grants of up to $26,000 to support small firefighting and ambulance equipment purchases. A total of $3.3 million was awarded to 149 fire departments and EMS providers across the state through the program.

Two grant recipients are located within the 57th Senate District:

- French Village Fire Department - $20,282.28

- East St. Louis Fire Department - $26,000

“Departments have had to make tough financial decisions, especially this year during the COVID-19 pandemic,” said Illinois State Fire Marshal Matt Perez. “The Small Equipment Grant Program helps reduce the burden on smaller departments/districts while replacing aging and sometimes failing small equipment.”

A complete list of recipients and awards can be found on the OSFM website.

- Details

- Category: Senator Patrick Joyce News

PARK FOREST – In an effort to promote resources available to small businesses and hear from small business owners and entrepreneurs, Senator Patrick Joyce (D-Essex) is accepting applications to tour shops, restaurants and other establishments in the 40th Senate District.

PARK FOREST – In an effort to promote resources available to small businesses and hear from small business owners and entrepreneurs, Senator Patrick Joyce (D-Essex) is accepting applications to tour shops, restaurants and other establishments in the 40th Senate District.

“Small businesses are the heart of our communities,” Joyce said. “I am asking local businesses to submit their information and schedule a tour, so we can help empower and support our entrepreneurs as the state moves forward from the pandemic.”

Joyce said he hopes to tour restaurants, retail shops and businesses that provide personal services, like spas and salons. All tours will be in compliance with the state’s public health guidelines and restrictions.

Applications are open, and interested business owners can find the application at SenatorPatrickJoyce.com/SmallBusinessTours. Joyce plans to start the program in the coming weeks and requests that businesses submit their applications soon. Once an application is received, a member of Joyce’s team will respond with additional details.

Those with questions can contact Joyce’s office at 708-756-0882 or visit SenatorPatrickJoyce.com.

- Details

- Category: Senator Mike Simmons News

CHICAGO – State Senator Mike Simmons (D-Chicago) is partnering with Gerber/Hart Library and Archives Friday to host a Pride Month Reflection press conference.

CHICAGO – State Senator Mike Simmons (D-Chicago) is partnering with Gerber/Hart Library and Archives Friday to host a Pride Month Reflection press conference.

Simmons, who is the first openly gay member of the Illinois State Senate, will be joined by representatives from Gerber/Hart and several other Chicago-based LGBTQA+ advocacy and support groups to reflect on Pride Month, recognize and acknowledge the hard work of advocates, honor and lift up survivors of violence, and discuss the progress that has been made and the work that remains to be done.

Read more: Simmons and Gerber/Hart to host Pride Month Reflection press conference

- Details

- Category: Senator John Connor News

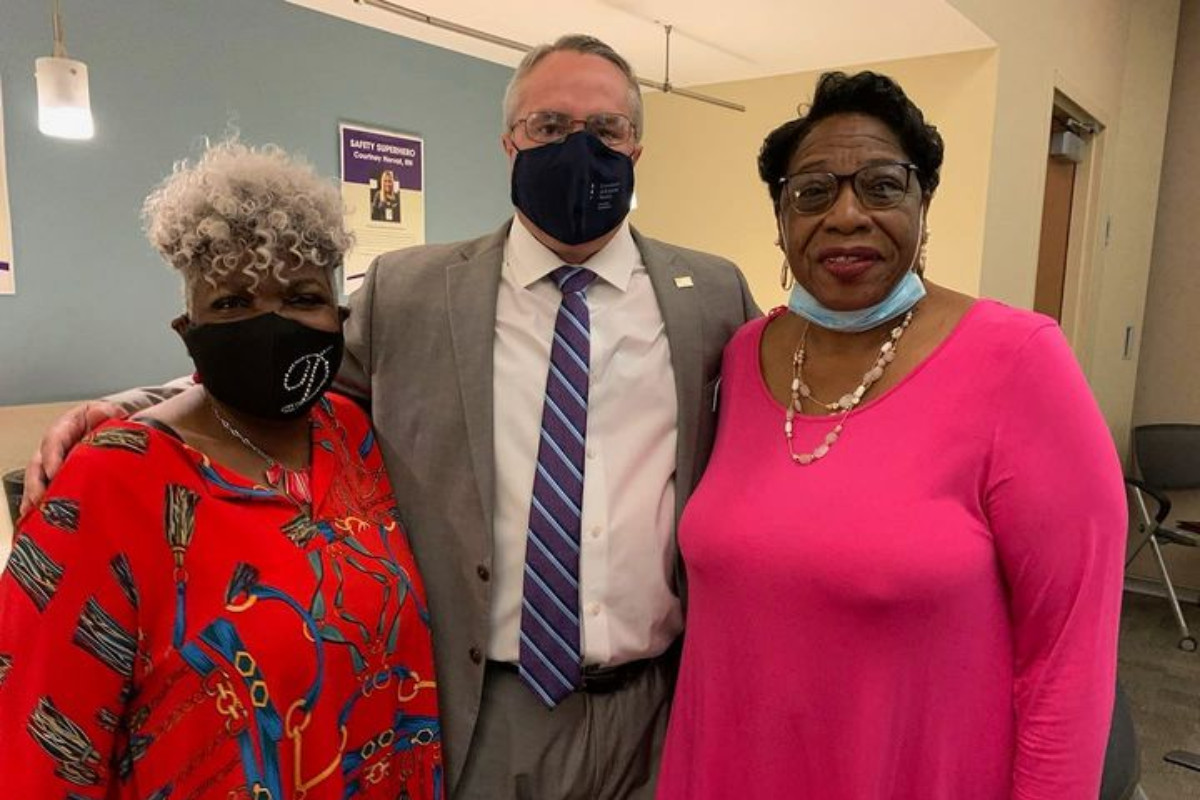

NEW LENOX – State Senator John Connor (D-Lockport) attended the Illinois Health and Hospital Association’s inaugural Health Equity Action Day at Silver Cross Hospital in New Lenox last week.

NEW LENOX – State Senator John Connor (D-Lockport) attended the Illinois Health and Hospital Association’s inaugural Health Equity Action Day at Silver Cross Hospital in New Lenox last week.

“It is incredibly fitting to kick off the weekend of Juneteenth, our newest federal holiday, with a discussion on how to create greater equality right here in Illinois,” Connor said. “Our community benefits greatly from Silver Cross and the work that they do to bridge disparities in health care for our Black and Brown neighbors, and while we still have a long way to go, we have the momentum we need to get there.”

Other notable participants at the Health Equity Action Day included Will County Executive Jennifer Bertino-Tarrant, State Senator Michael Hastings (D-Frankfort), members of the Healthy Community Commission and Diversity, Equity and Inclusion Council and several hospital leaders. The group engaged in a roundtable discussion regarding racial disparities in health care and how to best address them, especially in light of the manner in which COVID-19 disproportionately ravaged communities of color.

Silver Cross Hospital founded its Healthy Community Commission in 2008 in an effort to create a stronger, healthier future for everyone it serves. The community-based organization provides support for education, workforce development training and enrichment activities for local youth. It has awarded $2.5 million in educational scholarships and workforce development grants to numerous Joliet-area residents and organizations over the last 13 years.

“The best way to tackle any problem is to do it together,” Connor said. “I look forward to continuing to work alongside this fantastic team to ensure that all Illinoisans have access to affordable and equitable health care.”

Those wishing to learn more about the Healthy Community Commission can visit Silver Cross’s website.

- Details

- Category: Senator Christopher Belt News

East St. Louis – State Senator Christopher Belt (D-Swansea) is reminding people to look out for text and email scams asking for personal information from someone pegging themselves as the Illinois Department of Transportation.

East St. Louis – State Senator Christopher Belt (D-Swansea) is reminding people to look out for text and email scams asking for personal information from someone pegging themselves as the Illinois Department of Transportation.

“With the increase in hacking, residents need to be aware of who they are giving personal information to,” Belt said. “I urge everyone to take precaution when receiving a text message or email saying it’s from IDOT.”

While the messages might look official, IDOT will not request personal information, such as Social Security numbers or bank information, via text or email.

To protect personal information, take the following precautions:

- Delete unsolicited emails and texts requesting personal information or promising state driver’s licenses or IDs;

- Do not click on any links contained in such emails or texts, as they may place malware on your computer or devices;

- Hang up on any calls, including robocalls that ask you to take immediate action or provide personally identifiable information;

- Ask to use other types of identifiers besides your Social Security number;

- Keep software up to date, including operating systems and antivirus protection programs on your computer, phone and other devices.

“I have no respect for those who participate in fraudulent schemes,” Belt said. “IDOT will not ask for your personal information through text or email, and the department is working around the clock to keep you safe.”

- Details

- Category: Member News

As the spring legislative session ended and the state opened up, Senate Democrats have been hard at work getting out into their communities. Tuesday evening, Senators Cristina Pacione-Zayas (D-Chicago), Steve Stadelman (D-Rockford), and Ann Gillespie (D-Arlington Heights) held events to engage with the residents of the districts they represent.

As the spring legislative session ended and the state opened up, Senate Democrats have been hard at work getting out into their communities. Tuesday evening, Senators Cristina Pacione-Zayas (D-Chicago), Steve Stadelman (D-Rockford), and Ann Gillespie (D-Arlington Heights) held events to engage with the residents of the districts they represent.

Senator Stadelman hosted an informational webinar in conjunction with the Citizens Utility Board on cutting the cable cord and exploring alternatives to satellite or cable television. Check out a recording of this event here. Additionally, he will be hosting a town hall on June 23 at the Northwest Community Center, located at 1325 N. Johnston Ave. in Rockford, from 6 to 7 p.m.

Read more: Senators hold events to increase community involvement

- Details

- Category: Member News

Last week, Gov. JB Pritzker signed legislation to declare June 19 a state holiday to recognize Juneteenth National Freedom Day. On June 19, 1865, two and half years after the Emancipation Proclamation, Federal troops arrived in Galveston, Texas to announce the end of slavery and ensure that all enslaved people were freed – effectively ending slavery in the United States.

Last week, Gov. JB Pritzker signed legislation to declare June 19 a state holiday to recognize Juneteenth National Freedom Day. On June 19, 1865, two and half years after the Emancipation Proclamation, Federal troops arrived in Galveston, Texas to announce the end of slavery and ensure that all enslaved people were freed – effectively ending slavery in the United States.

Many members of the Illinois Senate Black Caucus participated in celebratory events in around the districts they represent to commemorate the significance of the holiday.

Read more: Senate Black Caucus celebrates Juneteenth holiday in local districts

- Details

- Category: Majority Report

Illinois Senate Black Caucus celebrates

On June 19, 1865, two and half years after the Emancipation Proclamation, Federal troops arrived in Galveston, Texas to announce the end of slavery and ensure that all enslaved people were freed. Now, over 150 years later, Illinois has declared June 19 a state holiday to recognize Juneteenth National Freedom Day.

The initiative, led by Senate Majority Leader Kimberly A. Lightford (D-Maywood) began as an effort to keep Black history alive in Illinois by creating a statewide celebration of African American freedom and independence.

New election law signed to encourage more voters to participate

SPRINGFIELD – Following the success of a law to provide more efficient ways for people to cast their ballot from home during the peak of the pandemic, a new proposal to make voting by mail permanently more accessible was signed into law.

“This keeps in place a number of voter conveniences that have proven popular,” said Senate President Don Harmon (D-Oak Park). “It’s a great example of lawmakers listening to the diverse voices of voters and taking steps to maintain and encourage voter participation.”

FOID card modernization, elected Chicago School Board legislation head to governor

SPRINGFIELD – A measure to keep guns out of the hands of dangerous people and another to transition the Chicago School Board to fully elected – both of which were championed by two Democratic senators, respectively – are just a step away from becoming law.

House Bill 562, led by State Senator Dave Koehler (D-Peoria), would help keep communities safe by enhancing existing background check protocols, empowering partnerships with law enforcement, and dedicating mental health funding to communities most impacted by gun violence.

“We have to keep our communities safe by preventing guns from falling into dangerous hands, while at the same time not infringing on the rights of responsible gun owners,” Koehler said. “This legislation helps achieve both goals.”

Under the measure, electronic copies of both FOID cards and concealed carry licenses will also be made available to make it easier for people to have their licenses on them at all times. It also creates a task force to aid in enforcement of FOID card revocation or suspension enforcement.

To reduce wait times for FOID cards, it also allows applicants to voluntarily submit their fingerprints.

Additionally, the Chicago School Board would become fully elected by 2026 if legislation spearheaded by State Senator Robert Martwick (D-Chicago) receives final approval from the governor.

House Bill 2908 would make the board fully elected starting in November 2026, following a two-year hybrid period. The hybrid period would begin after the November 2024 election, when 10 members would be elected and 10 would be appointed by the mayor. The board president would also be appointed by the mayor.

“Creating an elected school board allows for more accountability, more democracy, and more community influence on our city’s school board,” Martwick said. “We need a school board that acts in the interests of our students, families, and communities.”

Both measures await final approval.

In case you missed it

MEMBERS IN THE NEWS

Senator John Connor, Lockport: Lawmakers work to honor fallen Illinois State Trooper | The Herald-News

Senator Laura Fine, Glenview: Senator Fine: 'Investments In Mental Health Care Will Save Lives' | Patch.com

Senator Adriane Johnson, Buffalo Grove: YouthBuild Lake County's outdoor benefit a huge success | Daily Herald

Senator Karina Villa, West Chicago: Sugar Grove Township hosts Property Assessment and Exemption Open House June 23 | Daily Herald

Copyright 2021 - Illinois Senate Democratic Caucus - All Rights Reserved

More Articles …

- Bennett: Westville Area Fire Protection District receives grant for equipment upgrades

- Loughran Cappel, Connor encourage summer reading through book club

- Villa thanks first responders, announces funding for Montgomery & Countryside Fire Protection District

- Castro kicks off summer reading program to keep students engaged

Page 450 of 762

© 2026 Illinois Senate Democratic Caucus

© 2026 Illinois Senate Democratic Caucus