Turner calls for action to expand students’ access to service animals

- Details

SPRINGFIELD – School policies protecting access to service animals for students with disabilities could be strengthened under a proposal led by State Senator Doris Turner that aims to support all students, no matter their needs.

“As we continue to equip our students with resources and support in the classroom, we need to make sure they don’t face setbacks because of a lack of understanding or awareness of the law,” said Turner (D-Springfield). “We have a responsibility to make sure all students feel welcome at school.”

Read more: Turner calls for action to expand students’ access to service animals

Illinois one step closer to banning AI for teacher evaluations, thanks to Belt

- Details

SPRINGFIELD – State Senator Christopher Belt advanced a measure that would ban the use of AI tools in teacher evaluations.

SPRINGFIELD – State Senator Christopher Belt advanced a measure that would ban the use of AI tools in teacher evaluations.

“A teacher may get a bad performance review, just to find out that it was AI that gave them the bad review with no way to challenge the outcome,” said Belt (D-Swansea). “I think we can all agree that there’s nuance in the classroom, and we shouldn’t dehumanize it.”

Read more: Illinois one step closer to banning AI for teacher evaluations, thanks to Belt

Cervantes pushes for enhanced funding for education

- Details

SPRINGFIELD – State Senator Javier Loera Cervantes spoke about funding to improve underrepresented communities’ postsecondary education options at a rally hosted by Hope Chicago in front of the capitol today.

“People in underrepresented communities should have the same chance at future success as people from more privileged backgrounds. But that is not currently the case,” said Cervantes (D-Chicago). “However, giving more funding to organizations like Hope Chicago brings us closer to realizing that reality.”

Cervantes has been a proponent of Hope Chicago’s work since he started in office. He has worked to get more funding for the organization, including $8 million in Fiscal Year 2026 that Hope Chicago used to help students and parents with college affordability and accessibility. He hopes there is even more funding this year to help students from underprivileged communities secure their future, whether that is at a university, trade school or joining the workforce.

Read more: Cervantes pushes for enhanced funding for education

Cervantes speaks on utilities legislation protecting consumers

- Details

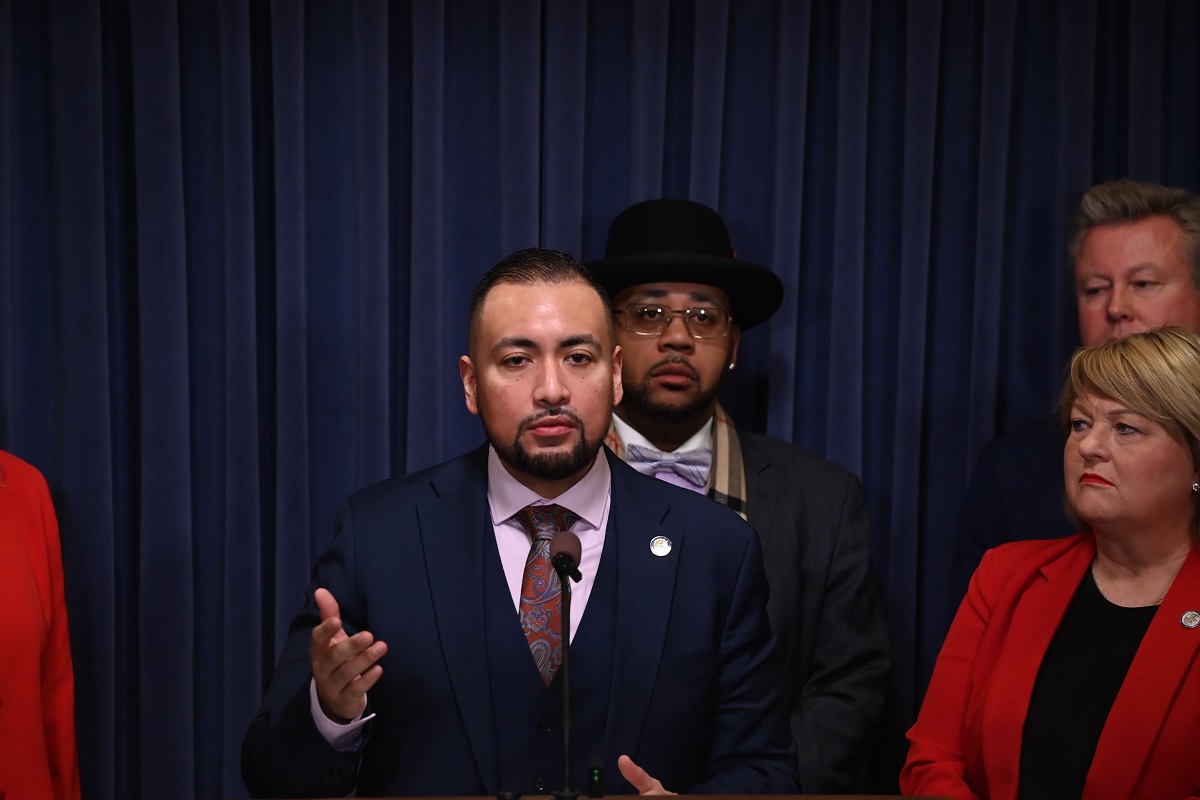

SPRINGFIELD – State Senator Javier Loera Cervantes was joined by the Clean Energy Choice Coalition and his colleagues for a press conference on a proposal that would make utilities more affordable, accessible and environmentally friendly.

“This is an issue from rural Illinois to Chicago,” said Cervantes (D-Chicago). “Consumer protection is extremely important for us to get in front of. As the energy sources change, we need to make sure that we protect our consumers statewide.”

Read more: Cervantes speaks on utilities legislation protecting consumers

More Articles …

Page 2 of 744

© 2026 Illinois Senate Democratic Caucus

© 2026 Illinois Senate Democratic Caucus