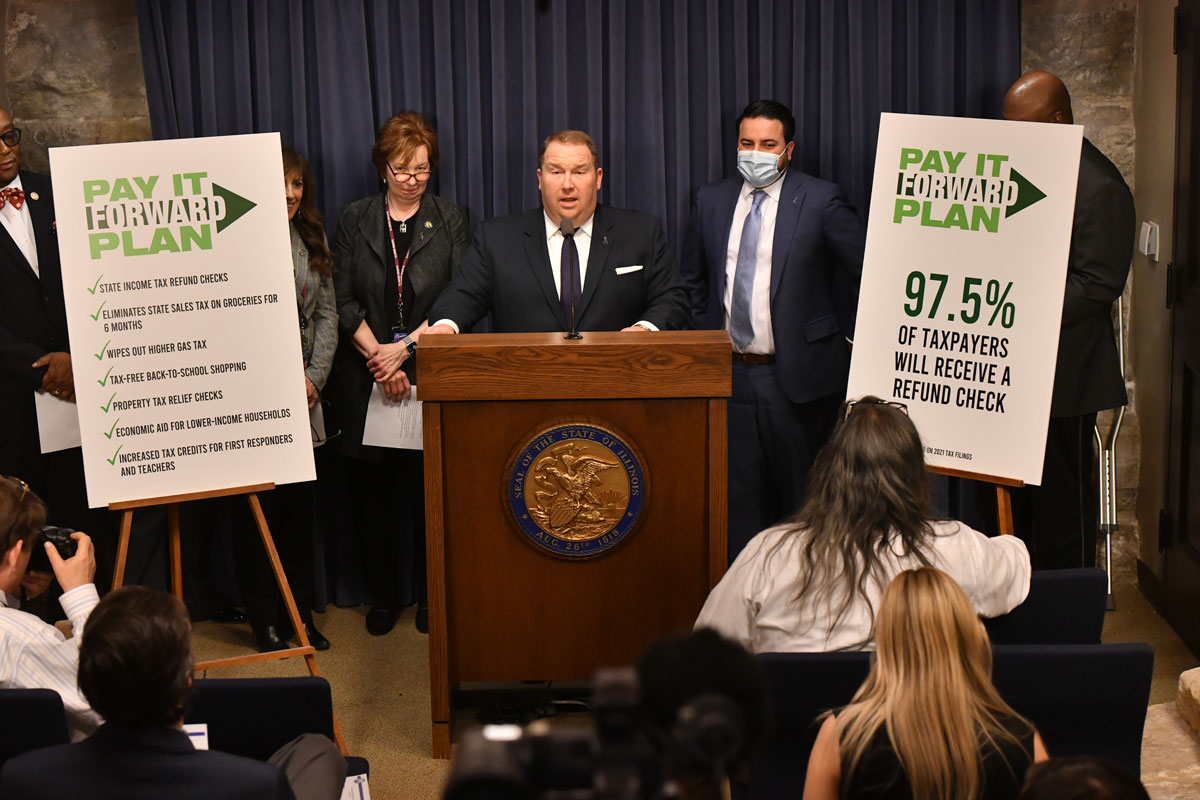

Senate Democrats unveil inflation addressing relief plan

SPRINGFIELD – Illinois Senate Democrats hosted a press conference in Springfield Friday outlining a more than $1.8 billion inflation-busting relief plan that would wipe out state taxes on back-to-school shopping and groceries, stop rising gas taxes and deliver income and property tax refund checks statewide.

“This plan gets money back in the hands of consumers. They’ve endured through this pandemic. It’s time for the state to put money back in the pockets of Illinois families,” said Senator Scott Bennett (D-Champaign).

Under their plan, the state would directly deliver relief checks valued at $100 per person and $50 per child to state taxpayers making up to $250,000 individually or up to $500,000 jointly. A household of four could see a $300 check.

The relief checks would likely come in late summer or early fall. Lawmakers estimated more than 97 percent of state taxpayers would get a check of some amount.

To qualify, people would need to have filed their 2021 return by the filing deadline, fit the income criteria, and they will automatically receive a check in the mail.

The plan also wipes out for six months the state sales tax on groceries and stops a gasoline tax increase from happening. The proposal is modeled after one Gov. JB Pritzker proposed in his budget speech earlier this year.

“We’re going to drive down skyrocketing gas and grocery costs and give people some needed relief,” said Senator Elgie Sims (D-Chicago).

The plan also includes property tax relief checks of up to $300 that would be mailed to taxpayers.

“Homeowners need help and this plan delivers direct relief to them,” said Senator Ann Gillespie (D-Arlington Heights).

The plan also wipes out the state sales tax on clothing, shoes and school supplies for 10 days in August to give consumers an economic boost as they go back-to-school shopping. As proposed, the sales tax would be lifted from Aug. 5 to Aug. 14.

“This recognizes the reality that families across the state face and should help lower the bill on their back-to-school shopping,” said Senator Michael E. Hastings (D-Frankfort).

Qualifying clothing and footwear with a retail price of $125 or less will have no sales tax during that time.

The comprehensive proposal also includes expanded economic aid for lower-income workers and increased tax credits for teachers and volunteer first responders.

The plan, included in legislation filed Friday in the Senate, totals more than $1.8 billion in economic relief. It could be voted on in the coming days as the legislative session heads toward a planned adjournment on April 8.

“Through responsible budgeting the state has wiped out deficits and paid our bills. Now is the time to pay it forward and get money back to taxpayers,” said Senator Bennett.

Copyright 2022 - Illinois Senate Democratic Caucus - All Rights Reserved

© 2026 Illinois Senate Democratic Caucus

© 2026 Illinois Senate Democratic Caucus